Purchasing property for refurbishment and then ‘flipping’ the finished result is a popular development model across the UK. The country’s commercial market is a testament to this, with the capital value of commercial real estate doubling since 2000.

Knowing how to use the financing options available is essential for getting your projects off the ground, which is where bridging loans come in. In this guide, we will discuss how property refurbishment bridging loans work.

What is a refurbishment bridging loan?

Refurbishment bridging loans are short-term financial instruments to fund your property purchase and any subsequent refurbishment work. It’s a standard type of bridging loan, meaning it functions in the same way as other bridging loans.

The loan is secured against your property, and you repay it plus interest after selling or refinancing the finished property. Due to the short-term nature of these loans, they work best when used for mild to moderate refurbishments. Ideally, they’re used for small-scale development projects. If you need anything more, you may want to consider longer-term options, such as development finance.

How to use a bridging loan to refurbish commercial property

Commercial property refurbishment is booming, with opportunities to purchase run-down commercial establishments and ready them to generate an income. But how do you use them?

Firstly, you need a property to purchase and a sufficient deposit. Most lenders only provide 75% Loan-to-Value products, meaning you’ll need to source the remaining money elsewhere. Moreover, you need to demonstrate to any prospective lender that you’ve got a feasible project that will enable you to carry off your exit strategy.

For example, suppose you’ve found prime commercial premises in London. In that case, you automatically have a strong application because 36% of UK commercial property value is in the capital, making it a development hotbed.

Showing a viable project means providing cost breakdowns, detailed timelines and information on the dedicated team surrounding you. An area of particular focus will be what you intend to use the money for.

Examples of how you can use refurbishment loans include:

· General refurbishment

· Cosmetic alterations

· Upgrading central heating systems

· Plumbing work

· Electrical work

· Property extensions

· Residential-to-commercial conversion

Most of these loans are used on properties other lenders wouldn’t touch. This is why many developers use these loans and then refinance into a traditional commercial mortgage later.

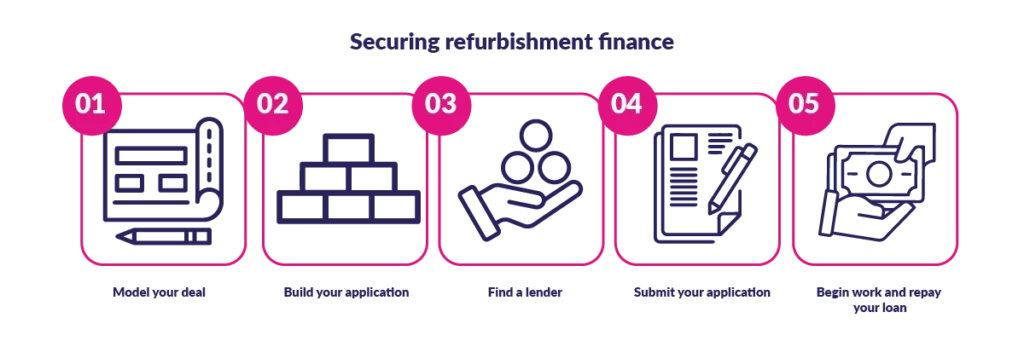

Once you’ve decided what you want to do, the process of securing refurbishment finance looks like this:

· Step One – Model your deal. Ensure you have sufficient margins and a feasible exit strategy. Not every deal is suitable for bridging finance.

· Step Two – Build your application. Focus on your exit strategy and ensure you have the numbers to support your assertions.

· Step Three – Find a lender. It’s generally easier to use a broker because they have established networks they can exploit, thus pairing you with the most suitable lender.

· Step Four – Submit your application and allow the lender to conduct valuations. If approved, you’ll enlist a solicitor to represent your interests and review the final loan agreement.

· Step Five – Begin work and repay your loan. Since these loans are usually non-serviced, you won’t make monthly payments. Instead, the principal plus interest is repaid in one lump sum after executing your exit strategy.

The key to using bridging loans for refurbishing property is knowing your timeline. Since the average loan term is 12-18 months, attempting major structural changes isn’t recommended. For large-scale projects, look into development financing.

Why use a commercial refurbishment bridging loan?

Commercial refurbishment bridging loans offer advantages you won’t find with other financial products. Some of the reasons to deploy them include:

· Speed – These loans can be approved in a few days. Contrast this to traditional mortgages, which could take up to three months or more to process. This fast approval timeline enables you to act on prime opportunities, such as those in the UK’s auction houses.

· Flexibility – Refurbishment loans can be used for various projects, from adding rooms to an establishment to modernising the plumbing systems.

· Lower Barriers – Unlike mortgages, the main factors lenders consider are your exit strategy and the feasibility of your project. Your regular income and credit rating are less important for a successful application.

Criteria for a refurbishment bridging loan for commercial properties

Whether you’re an individual or a company, as long as you’re over 18, a UK resident, or a UK citizen, you already meet the basic eligibility criteria for a bridging loan. However, other factors do come into play.

For example, your Loan-to-Value (LTV) will be a huge factor. Today, the average LTV for short-term lending is 58.7%. Lowering your LTV by increasing your deposit or adding extra collateral will enable you to unlock the best rates.

As a secured loan, your bridging loan will be secured against the commercial property and/or other assets. This means they can be seized if you default on your loan. However, one of the advantages is that whilst lenders run credit checks, your score is less important. Instead, creditworthiness defines your rates rather than whether you qualify at all.

Other eligibility criteria include:

· Experience

· Exit strategy

· Project feasibility

· Borrowing minimum

Whether you meet the eligibility criteria also depends on the lender’s own requirements. Using a bridging loan means you need to move fast and can’t afford a rejection because of specific criteria. That’s why working with a financial broker like Hilton Smythe is so valuable.

Our market experts are well-positioned to point you in the direction of the most suitable lenders with the lowest rates. To learn more about leveraging our bridging finance network, contact the team today.