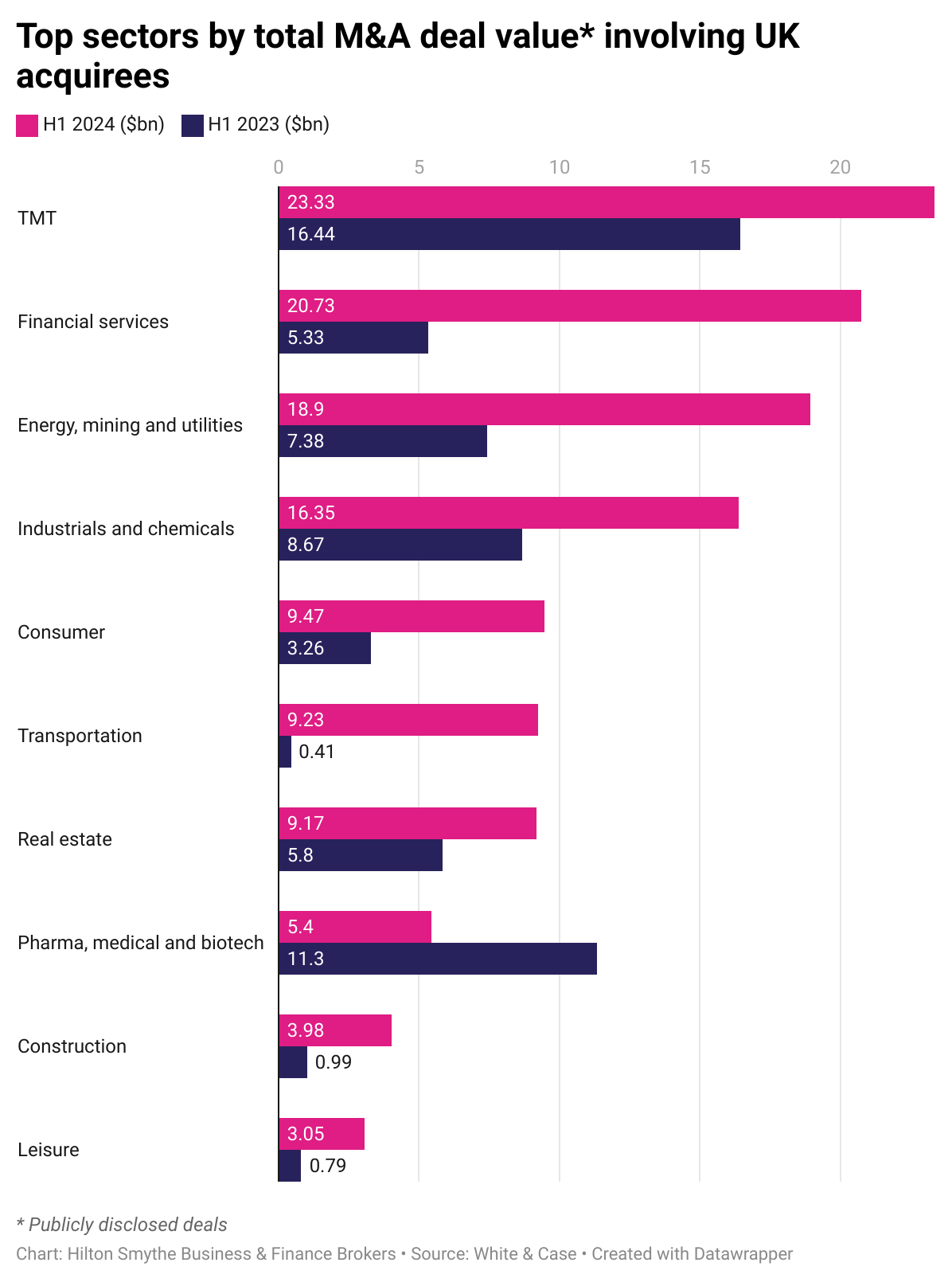

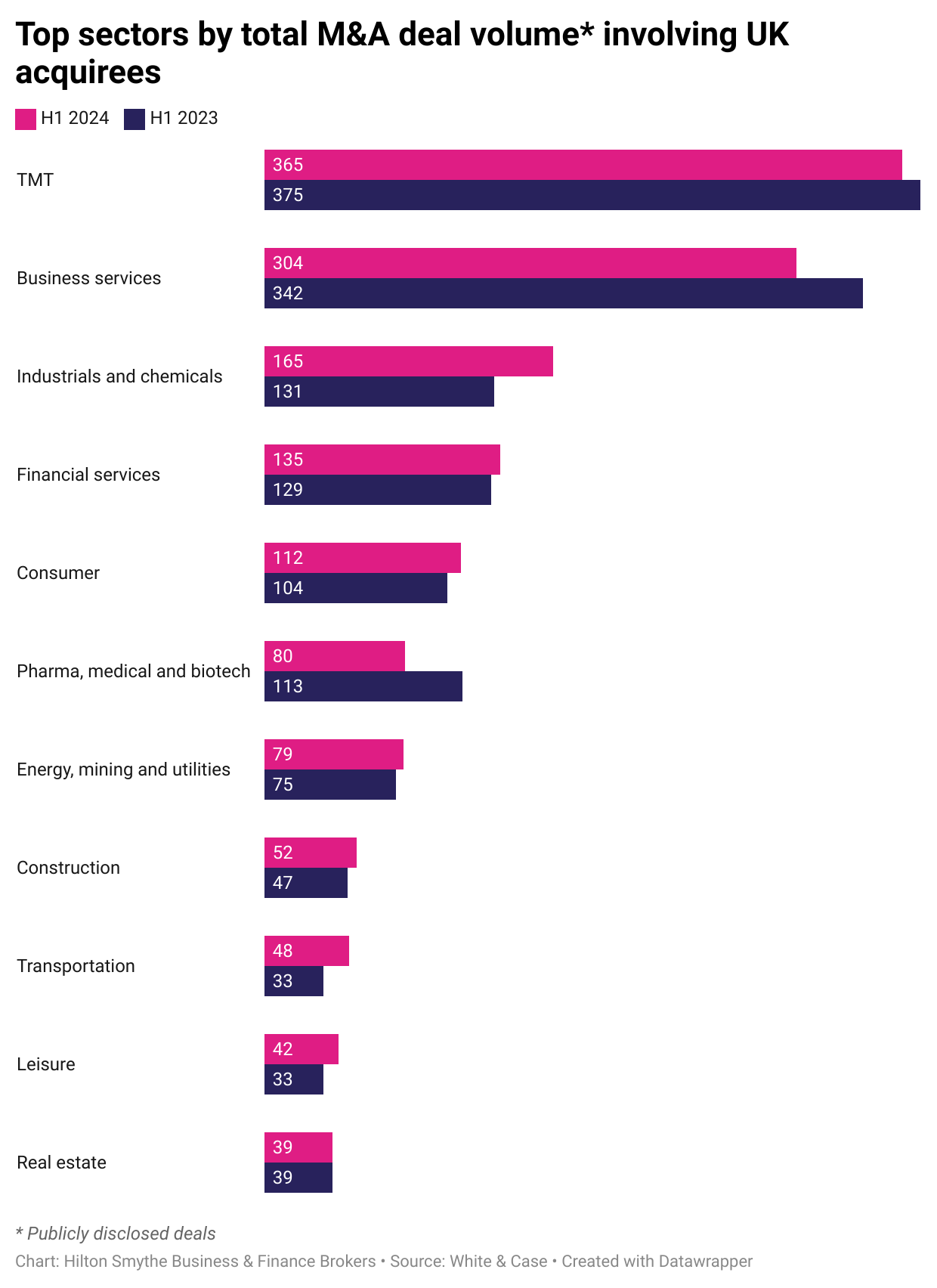

By deal value, TMT (Technology, Media and Telecom), financial services, and energy, have emerged as the top sectors for UK M&A in H1 2024, while TMT, business services, and industrials & chemicals have emerged as the top sectors by deal volume.

TMT remains the most sought-after sector in UK M&A by deal volume and deal value

TMT held its long-standing position as the most attractive sector in UK M&A with 365 deals completed in H1 at a combined transaction value of $23.33 bn.

According to Crunchbase, 123 of publicly-disclosed deals completed in H1 2024 fell under the software category.

SME and mid-market software deals completed over the past few weeks include VitalHub’s £2.16 million purchase of Premier IT Networks, a provider of secure cloud computing solutions to data-sensitive sectors.

US group Tech Soft 3D also made a move for Thereom Solutions, a Staffordshire-headquartered software engineering company specialising in the digital twins and 3D visualisations.

TMT continues to attract investment due to its focus on digital transformation and operational efficiency, generative AI, and its scope for rapid scalability.

Energy M&A shows no sign of losing momentum

The energy sector, which was one bright spot during the 2023 deal-making slump, also remains a hotbed of M&A activity in the UK.

Total deal value amounted to $18.9 bn in H1 – a significant uptick compared to $7.38 bn in the same period in 2023.

SME and mid-market software deals completed over the past few weeks include IMS Heat Pumps’ sale to Hometree, a leading UK challenger brand in residential energy services.

And in February, Good Energy Group PLC entered into a conditional binding agreement to acquire JPS Renewable Energy and its subsidiary Trust Solar Wholesale in a deal worth more than £13m.

Energy M&A shows no sign of losing momentum, encouraged by the energy transition, government regulation and incentives, and a push amongst companies to diversify asset portfolios.

The transportation, construction, and leisure sectors experience a strong M&A recovery

The transportation, construction and leisure sectors have undergone a remarkable recovery in H1 2024 after a lackluster 2023. Total transaction value in transportation in H1 2023 stood at $0.41 bn and surged by a factor of 18 to $9.23 bn in 2024. In the construction sector, total transaction value stood at $3.98 bn – up from $0.99 bn.

This coincides with a broader economic recovery across these sectors. The UK Construction PMI recovered to 54.7 points in May from a low of 45 points in September 2023, while the transport and storage sector increased its output by 3.7% in the first three months of the year.

Industrials & chemicals and business services drive M&A deal volume in H1

Business services and industrials & chemicals emerged as the second and third most active sectors for UK M&A by deal count in H1 2024. The industrials & chemicals sector saw a notable uptick, with publicly disclosed deals rising from 131 in H1 2023 to 165 in H1 2024.

This surge aligns with broader industry trends, as chemical companies worldwide grapple with intensifying margin pressures. To combat these challenges, firms are increasingly turning to M&A as a strategic tool to reduce costs, gain market share, and bolster competitiveness.

Experts believe that two areas particularly ripe for M&A activity are the building and construction chemicals segment, and the CASE (coatings, adhesives, sealants, and elastomers) subsector.

Financial services show strongest climb in sector M&A rankings

The financial services sector showed the strongest climb in sector M&A rankings with total deal value increasing from $5.33 bn in H1 2023 to $20.73 bn in H1 2024. This trend of consolidation is expected to continue throughout the rest of the year, driven by high costs and a need to differentiate technology offerings.

In March, Nationwide, a major high-street bank, hit the headlines with its acquisition of competitor Virgin Money. The £2.9 billion cash transaction marks the largest banking merger in the UK since the 2008 financial crisis. Now cleared by the CMA, it will establish the country’s second-biggest provider of savings and mortgage services, boasting total assets of £368 billion.

Notable acquisitions in the SME and mid-market arena over the past few weeks include Marygold & Co’s acquisition of Staffordshire-based Step-By-Step Financial Planners, FRP Advisory’s acquisition of Hilton-Baird Management Services for £7m, and Fresh Financials Group’s purchase of AccountsForMe.

A hopeful outlook for H2 2024

Ian Flood, Head of Research at Hilton Smythe, says: “We have been experiencing particularly strong buyer interest in businesses operating in industrial and chemical production, renewable energy, and security services.”

“We’re seeing strong M&A recovery across the board, however. Key factors driving this hopeful outlook include the energy transition, accelerating digitisation, and the need to future-proof business models.”

“If you’re looking to sell, now is the perfect time to capitalise on growing buyer interest.”