2023 and 2024 have been subdued years for the sustainable finance market after the surge of 2021. However, some onlookers think that a rebound and growth is “inevitable”.

But firstly, what are green and sustainability-linked loans? Green loans are contingent loans or lines of credit designed to offer financial support (either through financing or guarantees) for projects that positively impact the environment.

Sustainability-linked loans, on the other hand, link finance terms to the achievement of predetermined sustainability performance targets. Tech giant Philips became an early pioneer of this method back in 2017 when it secured a €1 billion revolving credit facility from banking group ING which linked the loan’s interest rate to Philips’ annual sustainability performance.

What, however, does the future hold for these nifty financing tools, and how can British businesses stand to benefit?

Downturn for the sustainable finance market in 2023 and 2024

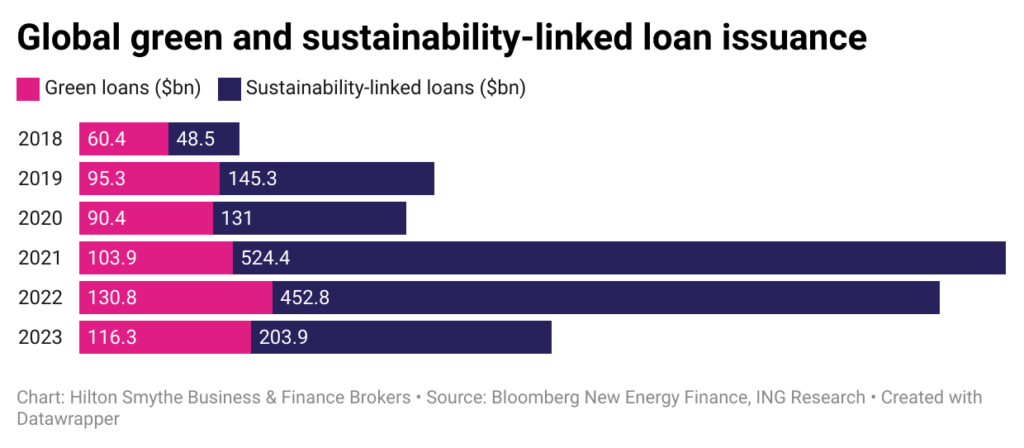

According to Bloomberg New Energy Finance, global sustainable finance issuance dropped to $1.3 trillion in 2023, down from $1.55 trillion in 2022 and well below the $1.8 trillion peak reached in 2021.

The first half of 2024 also looked rather lacklustre: issuance of sustainable debt around the world reached $800bn, almost at the same level as that in the first half of 2023.

ING attributed last year’s faltering demand for sustainable finance debt to investors reassessing the market, greenwashing concerns and the need for greater regulatory clarity, while Natwest linked the decrease in sustainable lending volumes to “the stringent requirements of green projects”.

No doubt wider geopolitical tensions, uncertain economic outlooks, and higher interest costs have also come into play. Data provider Wood Mackenzie, for example, states that the “high capital intensity and low returns on green projects make them particularly vulnerable to high intertest rates”.

Positive market drivers for green, sustainable finance in 2024/25

Along with the push from eco-conscious consumers, the regulatory landscape is only getting stricter, so companies will need to step up their sustainability game to stay ahead.

For example, the Public Procurement Notice (PPN) 06/21 mandates that businesses bidding for contracts exceeding £5 million with the UK government, or over £10,000 with the NHS, demonstrate a commitment to carbon reduction.

Tightening waste and packaging regulations under the Extended Producer Responsibility (EPR) scheme will also make businesses financially responsible for the lifecycle impact of their products, from production to disposal. This is likely to have a significant impact on SMEs in sectors like manufacturing, logistics and retail, where they’ll be pushed to invest in sustainable packaging solutions, improved recycling systems, and waste reduction technologies.

“Large undertakings” must also remain compliant under the Energy Savings Opportunity Scheme (ESOS). This means undergoing mandatory energy assessment schemes and implementing any improvements identified under the audits.

Sustainable finance is also being mobilised by the EU’s Sustainable Finance Disclosure Regulation (SFDR), which requires financial institutions to disclose how they consider sustainability risks and impacts in their investment decisions.

Indeed, the UK’s biggest banks—NatWest, Barclays, HSBC, and Lloyds—have all rolled out hefty financing packages to help businesses go greener and meet their financial targets.

The big players in the UK’s green lending market

The menu of sustainable financing options has grown in recent years

Several big players in the UK’s green lending market have stepped up their game in recent years, offering sustainable financing options to businesses, particularly SMEs.

NatWest Group joined the other top high street banks in 2022 by offering general green loans and asset financing for SMEs. These loans cover everything from retrofitting buildings to adopting clean energy solutions like solar panels and electric vehicles.

HSBC introduced a £500 million ‘Green SME Fund’ in 2021, specifically to help smaller businesses invest in sustainable projects, and offer cashback incentives on loans.

Lloyds has been in the game since 2018 with their £2 billion Clean Growth Finance Initiative, which offers discounted loans to businesses focused on reducing their environmental impact. These funds are designed to support clean energy adoption, low-carbon buildings, and sustainable agriculture.

Barclays also launched its ‘Green Loans’ product that same year. And just last month (September 2024), Barclays discounted the interest rate across four of its Green Loans in a bid to make emission reduction less cost-prohibitive for businesses.

Which sectors stand to benefit from green loans and sustainability-linked financing?

In Q1 2024, green lending activity was primarily focused on a few key sectors like industrials, real estate, and energy & utilities.

Indeed, one of the standout sectors that will see big benefits from green and sustainability-linked loans is property—and not without reason. The UK has the oldest housing stock in Europe, and over half of England’s homes still fall short of meeting EPC band C, the minimum level for energy efficiency. There also exists “huge pent-up demand” for green refurbishment of existing commercial building stock.

Agribusiness is also a sector to watch when it comes to green loans. In Q1 2023, nearly 60% of lending in the sector was through green and sustainability-linked loans. Farmers are increasingly looking at energy-efficient machinery and renewable energy options like solar panels and anaerobic biodigesters for biogas production – however, those solutions come with some steep price tags. In fact, 45% of Barclays’ arable agriculture customers cited the high cost of equipment and machinery as one of the biggest barriers in their journey to net zero.

The direct financial perk for borrowers often comes in the form of lower interest rates on their debt. And some clean energy projects can even be structured to be cashflow-neutral or even cashflow-positive, where the energy savings from the project exceed the cost of loan repayments. It’s a win-win: go green and save money.

But the real value can extend far beyond that.

For example, real estate developers and property companies that demonstrate a commitment to ESG (Environmental, Social, and Governance) criteria are more likely to win contracts from clients who prioritise sustainability.

However, accessing green loans isn’t without its hurdles. Borrowers need to ensure they meet the compliance requirements tied to these loans, which can create an additional administrative burden. And for sustainability-linked loans, businesses must provide ongoing proof that they are achieving the sustainability targets tied to the financing.

Conclusion

With stricter regulations pushing businesses toward sustainability and increasing demand from eco-conscious consumers, companies will need to embrace green financing options to stay competitive.

While 2023 and early 2024 were subdued, the groundwork has been laid for a rebound.