There’s more that goes into business valuations than you might think.

Most people will know that revenue growth, profitability, and wider market conditions and multiple trends all influence business value.

However, capital structure, or the mix of money sources a company uses to fund its operations, is a less widely understood aspect of determining business value.

Many business owners might naturally shy away from taking on debt, seeing it as an unnecessary risk. However, when strategically managed, debt can actually enhance a company’s valuation by reducing taxable income and creating a “leverage effect” that boosts return on equity (ROE).

However, striking the proper balance between debt and equity, as we’ll explore, is important.

What is the “trade-off theory of capital structure”?

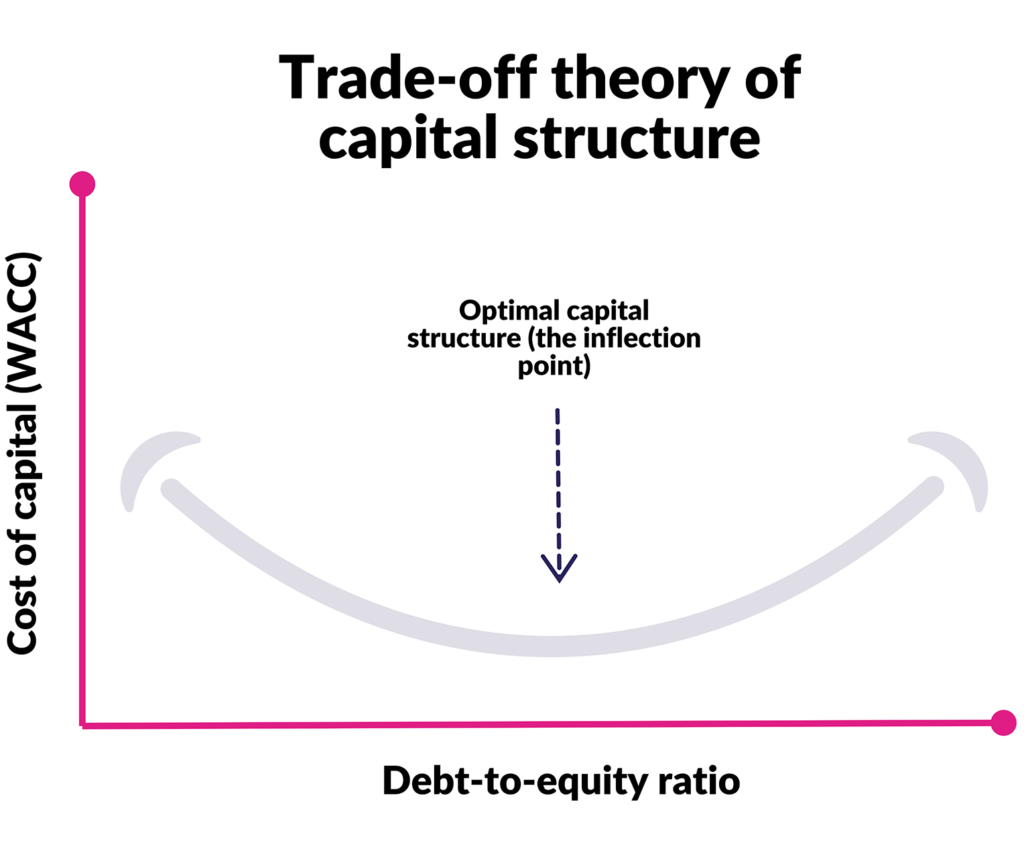

The trade-off theory of capital structure suggests that companies should find an optimal balance between debt and equity. By doing so, they aim to lower their weighted average cost of capital (WACC) and boost their value.

The idea is to enjoy the tax benefits of debt (like interest deductions) while avoiding the downsides of overloading on it, such as financial stress and potential cash flow headaches.

How does the trade-off theory work?

Businesses typically fund themselves in two ways: debt and equity.

-

- Debt: This is borrowed money, where companies pay regular interest and eventually return the principal. The bonus? Interest payments on debt are tax-deductible, creating what’s known as an “interest tax shield.” The downside? Debt brings fixed costs, so heavy reliance on it raises the risk of financial strain if revenues dip.

-

- Equity: This means selling shares of ownership to investors. Equity doesn’t come with mandatory payments, so there’s no added pressure to meet a monthly interest bill. However, bringing in more equity can dilute existing owners’ stakes and means the business must still act in the shareholders’ best interests.

In short, the trade-off theory suggests that the best capital structure balances the tax benefits of debt with the risks of taking on too much. Debt is often a cheaper option, while equity offers flexibility without fixed costs.

What is an ideal debt-to-equity ratio?

In a world without risk, more debt would mean greater value. However, at a certain point, high debt levels start to introduce financial risks that can outweigh these advantages. When debt reaches this tipping point, investors expect higher returns to compensate for the added risk, which can ultimately reduce the company’s value.

The optimal capital structure, then, is an optimal debt-to-equity ratio that maximises returns without excessive risk.

Finding this balance is part art, part science. Valuation professionals might look at:

-

- Industry averages;

-

- Capital structures of comparable companies;

-

- Financial institutions’ debt-to-equity lending criteria; and/or

-

- Financial modelling to estimate the best debt level for a company.

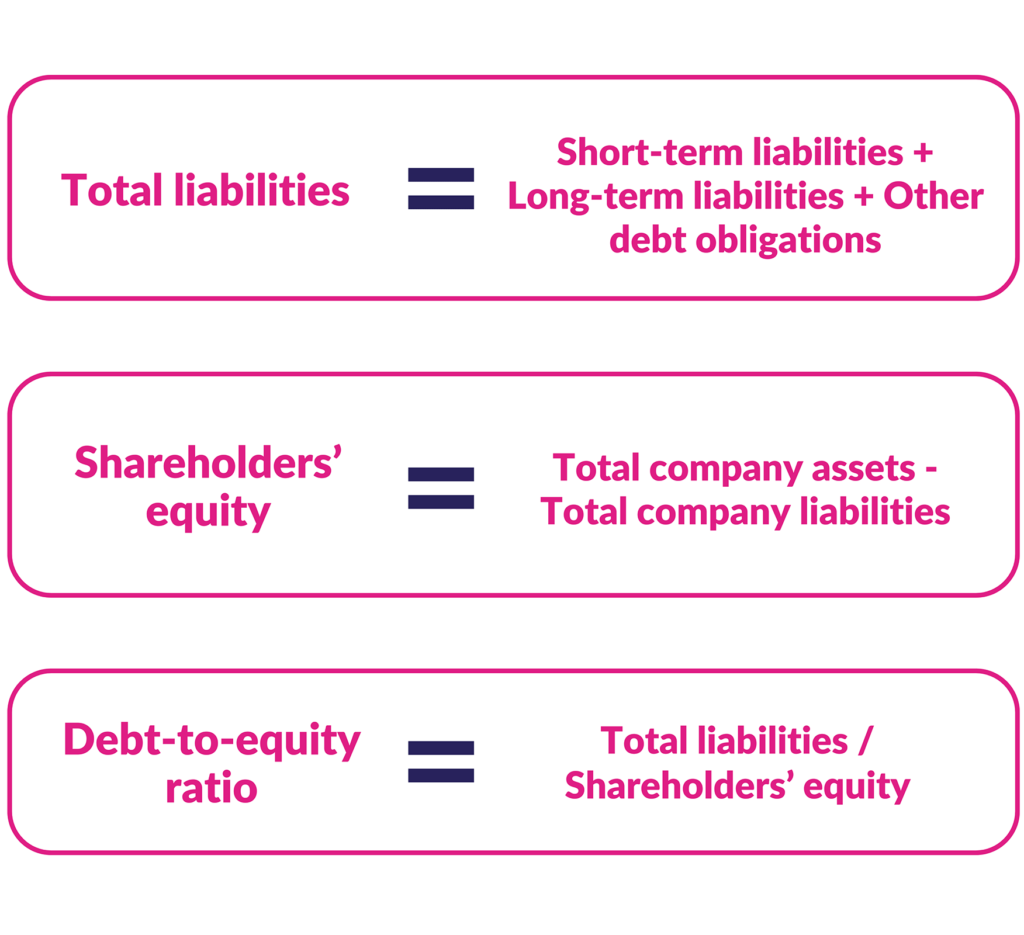

A healthy debt-to-equity ratio usually falls between 1 and 1.5, though in capital-intensive industries, it’s common to see ratios above 2.

Highly leveraged sectors like mortgage finance, healthcare facilities, leisure, and home improvement retail show just how different debt levels can be across industries, with debt-to-equity ratios ranging from around 2 to as high as 41.

How does debt affect business valuations?

Debt can be a double-edged sword when it comes to how much a business is worth, shaping both the risk and return considerations for investors.

On the one hand, if a company’s return outpaces its Weighted Average Cost of Capital (WACC), it’s essentially generating extra value beyond what it’s paying to finance its growth. Imagine a company pulling in a 20% return against an 11% WACC—that’s an extra £0.09 in value for every pound invested. Not only is it covering its financing costs, but it’s also stacking up value, which makes it more attractive to potential buyers.

Debt can also give companies a boost in discounted cash flow (DCF) valuations, thanks to the tax-deductible nature of interest payments. This perk lowers a business’s overall cost of capital and bumps up its after-tax cash flow.

But there’s a catch: higher debt levels can make a company look riskier. A highly leveraged business might struggle if revenues dip, affecting its ability to meet debt payments. For this reason, highly leveraged companies may trade at lower valuation multiples due to increased risk.

In a nutshell…

Business valuations hinge on more than just revenue and profitability. While market trends and growth are familiar factors, a lesser-known but crucial element is capital structure—the mix of debt and equity used for funding. Although some business owners avoid debt, when managed strategically, it can actually boost valuation by reducing taxable income and enhancing return on equity (ROE).