Accurate business valuations are among the most important numbers in any business merger or transaction. However, assessing sufficient value is where opinions often divide.

The UK enjoys 1,015 businesses per 10,000 residents, making it one of the most thriving business communities in the world. But how do these businesses handle valuation disputes, and where do expert witnesses feature?

Let’s discuss what a valuation expert witness is and their role in the process.

What is a valuation expert witness?

Expert witness valuation is the process of valuing a business in a legal environment. An expert witness themselves is someone with the credentials that denote them as an expert in their field.

Valuation expert witnesses make up a relatively small part of expert disciplines in the UK. According to one study, only 7.77% of these experts fall into the finance category.

During legal disputes regarding business valuations, courts may call expert witnesses to give them a specialised opinion. The role of the expert witness is to provide an unbiased, independent opinion of the value of a business.

However, they don’t only feature in cases involving mergers and acquisitions. Valuations are pivotal in other matters, including financial reporting, tax matters and the most common use case, matrimonial. They may even be necessary to acquire a loan or in estate planning.

Who would call a valuation expert witness?

Valuation expert witnesses are viewed as objective and independent within the judicial realm. Any party engaged in a dispute may call a valuation expert to provide their own assessment of how much a business is worth.

In some cases, both sides may call their own valuation expert witnesses. The key is that despite being employed by either side, they are still expected to retain their neutrality and put any personal biases aside to maintain the legitimacy of the UK’s legal system.

Why would you need a valuation expert witness?

Valuation expert witnesses can be hired to deal with any number of disputes – and not all are related solely to disputes in M&A transactions.

Valuation expert witnesses feature in both civil and criminal cases. Likewise, they may also be called in to handle arbitration and mediation outside of a court setting. Here’s what their role may look like in each scenario:

· Civil – Valuation expert witnesses may assist courts or tribunals by providing professional opinions involving disputes like breach of contract.

· Criminal – These experts may be chosen to provide reports and testimony in cases like corporate fraud investigations and assess forfeiture proceedings.

· Arbitration & Mediation – In situations that can be resolved outside of court, valuation expert witnesses offer technical evidence and help to assess damages.

As you can see, valuation expert witnesses are helpful for countless types of business disputes you might encounter.

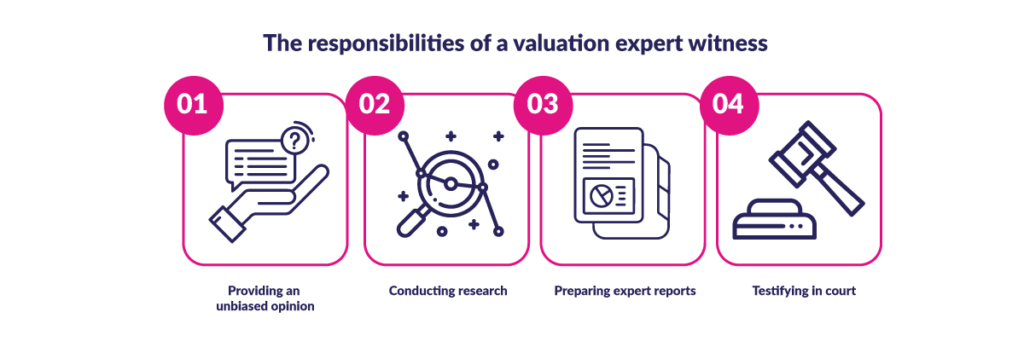

The responsibilities of a valuation expert witness

Expert witnesses have four core responsibilities in their profession, which are:

1. Providing an unbiased opinion

2. Conducting research

4. Testifying in court

Let’s take each of these four responsibilities in turn to gain a better understanding of their value.

Providing an unbiased opinion

Valuation expert witnesses are characterised by being objective and unbiased at every stage of a legal proceeding. Perceived bias damages their neutrality and the value of their opinion.

Note that this applies regardless of which side hires a particular expert witness. Their value is that – unlike a solicitor – they are not particular to either side, only to the facts.

Conducting research

Extensive research and analysis using accepted technical valuation methods is where their core expertise lies. They are expected to use validated techniques to form professional opinions that can be defended and argued successfully.

Preparing expert reports

Valuation expert witnesses use systematic methods to create expert reports to ensure their valuation process is accurate and precise.

Not only are these expert witnesses expected to prepare these reports but also to present them within a legal setting.

Testifying in court

Valuation cases necessitating expert witnesses could require these experts to testify in court about the procedures they used to come to their independent valuation. Moreover, they may also be required to submit to cross-examination, making operating under pressure essential.

Pros and cons of using a valuation expert witness

Should you hire a valuation expert for valuation purposes? Like in so many cases, the answer depends on the situation. Your lawyers will be able to advise whether hiring someone is appropriate for your given case.

Valuation expert witnesses play a vital role in resolving disputes. On the other hand, they can also help avoid them in the first place. Deciding whether to hire one is ultimately a personal choice based on an assessment of the situation.

To help you make your decision, here’s a rundown of the benefits and limitations of valuation expert witnesses.

Pros

-

- Expert witnesses bring enhanced expertise and credibility to the table.

- They provide objective and unbiased opinions, assisting fact-finders along the way.

- In-depth research and analysis is accompanied by strong communication skills to reinforce your position.

- Valuation expert witnesses can mitigate the risks of incorrect and inaccurate valuations, enabling you to resolve disputes early.

Cons

-

- Expert witness valuations aim to be objective but rely on professional judgement, meaning perspectives and valuation techniques can differ from expert to expert.

- How accurate an expert witness valuation is still depends on the quantity and quality of data. Inadequate, out-of-date or biassed data may damage the expert’s own accuracy.

- Finding an expert witness who can stand up to scrutiny still presents a challenge. It requires the client to conduct their own in-depth research to ensure the expert carries the weight and gravitas needed to fight your corner.

At Hilton Smythe, we understand how challenging it can be to find a suitable professional for the right scenario. That’s why our range of services enables us to stand head and shoulders above the rest, including when it comes to sourcing experts. We have a very unique position in the market in that we have data for transactions impacting SMEs, and typically, firms do not have access to smaller SME deal data as it is not often reported in financial databases.

To learn more about our expert witness work, contact the team today.